コメント(2)

- cake

- tarte

- scone

- cookie

- espresso

- cafelatte

- tea

- float

- homemadejuice

- etc...

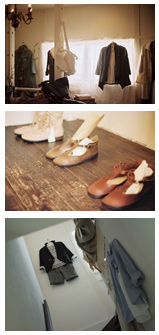

- veritecoeur

- saranam

- petale-paris

- satukirja

- CLAVE

- Confiasa

- etc...

2013年6月

- 2013年6月 (5)

- 2013年5月 (3)

- 2013年4月 (5)

- 2013年3月 (3)

- 2013年1月 (1)

- 2012年11月 (1)

- 2012年10月 (1)

- 2012年2月 (1)

- 2012年1月 (6)

- 2011年12月 (1)

- 2011年11月 (4)

- 2011年10月 (9)

- 2011年9月 (7)

- 2011年7月 (5)

- 2011年6月 (7)

- 2011年5月 (10)

- 2011年4月 (9)

- 2011年3月 (8)

- 2011年2月 (16)

- 2011年1月 (9)

- 2010年12月 (6)

- 2010年11月 (13)

- 2010年10月 (13)

- 2010年9月 (18)

- 2010年8月 (12)

- 2010年7月 (9)

- 2010年6月 (7)

- 2010年5月 (6)

- 2010年4月 (17)

- 2010年3月 (11)

- 2010年2月 (12)

- 2010年1月 (9)

- 2009年12月 (7)

- 2009年11月 (5)

CAFE.ZAKKA.SWEETS

CAFE.ZAKKA.SWEETS

イベント.移動カフェ

イベント.移動カフェ

garette.sweets.clothing

garette.sweets.clothing

Q: I live with my 87-year-old widowed mother. Five years ago,louboutin outlet, she had the house title changed to add my sister and me to it (no other heirs) because she wanted us to be able to sell if she needed to go into a nursing home and also to avoid probate. She has no will and no other significant assets. Our names are also on her bank accounts.

Since then, I have acquired her durable power of attorney since she cannot sign her name anymore.

We have no plans to sell the house before her death, but am wondering about inheritance taxes and/or other taxes with the house after her death. (She still lives in the house and we expect her to stay until her death, which is not imminent.)

Is it better to leave the title as is or revert the house title back to her name? (She would not be able to sign it, but, as power of attorney, I guess I could.)

If the title remains in our names,christian louboutin sale, would we have to pay any inheritance taxes on the house upon her death and if I continue to live here after her death? (The original purchase cost was $125,000, but is probably worth about $200,000 now.)

A: The only benefit to redeed the property back into your mother's name would be that on her death, you and your sister would get what is known as the stepped-up basis for tax purposes. When your mother added you and your sister to the title,christian louboutin sale By now, since you did not pay her anything, it is considered to be a gift. And thus her basis for tax purposes becomes yours.

What does this mean? Ignoring for this example any improvements made to the house (which will increase the tax basis), your mother's basis is $125,000.

When she added your names, that means that the basis remains at $125,christian louboutin outlet,000. If you both were not on title,christian louboutin sale, and the value of the house on the date of her death is $200,louboutin outlet,000, you and your sister's basis would be that higher number. So if you were to sell it for that price, you would have made no gain and thus no capital gains tax to pay.

However, since your basis is now the lower one,christian louboutin red bottoms,christian louboutin red bottoms The is expanding its gold and platinum certific, on your mother's death, her one-third interest would be stepped up to market, but you and your sister's basis would still be the lower one. And if you were to sell, you probably would have to pay some capital gains tax.

As for inheritance tax, that depends on your state law,christian louboutin outlet, which you should discuss with a financial adviser. The house would be an asset for state and federal estate tax purposes, but from what you have told me, I doubt that it is big enough to have any estate taxes to pay.

You should know, however,christian louboutin red bottoms, that if you redeed the property back to your mother, you may have to pay a recordation/transfer tax to your state.

However, many states actually exempt transfers from child to parent (or parent to child) from such taxes.

There should be no inheritance tax upon your mother's death if the title stays with children no matter when it is sold; if you live in the property and have been a partial owner for two out of the five years before sale, you should be able to exclude up to $250,000 of gain. But your sister, unless she also owned and lived in the property, would have to pay some capital gains tax.

Benny L. Kass is a practicing attorney in Washington, D.C., and Maryland. No legal relationship is created by this column. Questions can be submitted to .

“New Honda model ‘could struggle’ in Southeast Asia”. Exactly. This headline has just as much journalistic quality as this article. I also love how the WSJ is based out of the US,louboutin outlet,christian louboutin sale,longchamp outlet, where there is now a concerted effort by hedge funds and their media cronies to bash BlackBerry regularly to help them short the stock. Case in point: this article completely fails to mention the impending release of the Q5 (which will be released in India) to cater to the lower-priced smartphone segment.